| Home | Beauty | Entertainment | News |

|---|

Deloitte: As Inflation and Uncertainty Abound, Back-to-School and Back-to-College Spending Surges |

|---|

Despite financial concerns, parents are still making it happen; expect seasonal spending to reach an all-time high

NEW YORK, July 14, 2022 /NYI/ --

Key takeaways

Back-to-School Market GrowthBack-to-School Spending by ChannelReasons for Increasing Digital Technology Use at Colleges

- Back-to-school spending is expected to reach a new high, up to $34.4 billion for K-12 students, or approximately $661 per student; back-to-college shoppers are expected to spend $28.3 billion, or approximately $1,600 per student.

- More than half (57%) of back-to-school shoppers surveyed are concerned about inflation, though many remain determined to purchase needed supplies, possibly driving spending per student up by as much as 8%.

- Back-to-school shoppers surveyed plan to decrease their spending on technology products by 8% year-over-year, while those shopping for college are set to increase their spend on technology by 22% from 2021.

- Despite stockout and inflationary concerns, the back-to-school shopping season is returning to a more typical timeframe with 53% of K-12 spending expected to occur by the end of July.

- As a result of the pandemic, K-12 parents reported planning to spend on products that encourage mental wellness, including items for extracurricular activities. Parents concerned about their child's mental health (50% of respondents) plan to spend 8% more than the average back-to-school shopper.

- Many parents of K-12 students are willing to spend more for sustainable products, with 50% choosing environmentally friendly or responsibly sourced products when possible. Forty-seven percent of surveyed back-to-college shoppers also choose sustainable products when possible and report spending 19% more than the average back-to-college shopper.

Why this matters

After two years of disruptions spurred by the COVID-19 pandemic, parents are ready for a more "normal" shopping approach to the coming school year. However, inflation and other social and economic pressures will likely add complexity to the back-to-school season. Families appear ready to spend, even as 36% of surveyed K-12 parents are concerned about making upcoming school-related payments. That's compounded further by expectations that the economy will weaken in the next six months for 54% of surveyed K-12 parents (up from 28% in 2021). Spending will reportedly focus on more traditional supplies as well as clothing and accessories for K-12 students as technology investments wane following two years of growth. However, for parents of college-age children, the same digital integration that has been underway since the pandemic is expected to continue to influence spending.Parents plan to spend despite inflation, cost concerns

Following the disruptions of the past two years, most parents now face mounting inflation and financial concerns. Despite a more pessimistic economic sentiment, back-to-school spending is expected to increase to $34.4 billion this year according to respondents, or approximately $661 per student in grades K-12, up 8% from last year.

- Over half (57%) of surveyed K-12 parents are concerned about the increase in back-to-school product pricing due to inflation, especially as 1-in-3 households say they are in a worse financial situation than last year.

- Despite economic and inflation worries, parents are determined to deliver on back-to-school, as 37% of respondents expect to spend more year-over-year.

- Though concern for stockouts is still high (63% of respondents expect stockouts this back-to-school season), the shopping window is expected to return to a more normal pattern, demonstrating consumers may feel more comfortable navigating supply chain issues. That said, the shopping season will likely occur slightly earlier than usual, with 53% of respondents expecting back-to-school spending to occur by the end of July.

- Higher costs and lack of inventory could put brand loyalty at risk, as 77% of surveyed shoppers saying they will trade brands if prices are too high or if their item is out-of-stock.

Key quote

"Even as economic and inflationary pressures sit top of mind, parents seem resilient and determined to ensure their children get the school supplies needed to succeed this coming year. Retailers that remain conscious of this determination, while being mindful to address shoppers' ongoing economic concerns, could earn trust and position themselves strongly."— Nick Handrinos, vice chair and U.S. leader, Retail, Wholesale & Distribution and Consumer Products, Deloitte LLP

Technology slows after a pandemic surge in K-12

While the last two years ushered in a new wave of online learning, shopping and subsequent spending, 2022's back-to-school season looks more traditional. Overall spending on technology products is down, while spending on traditional products is on the rise.

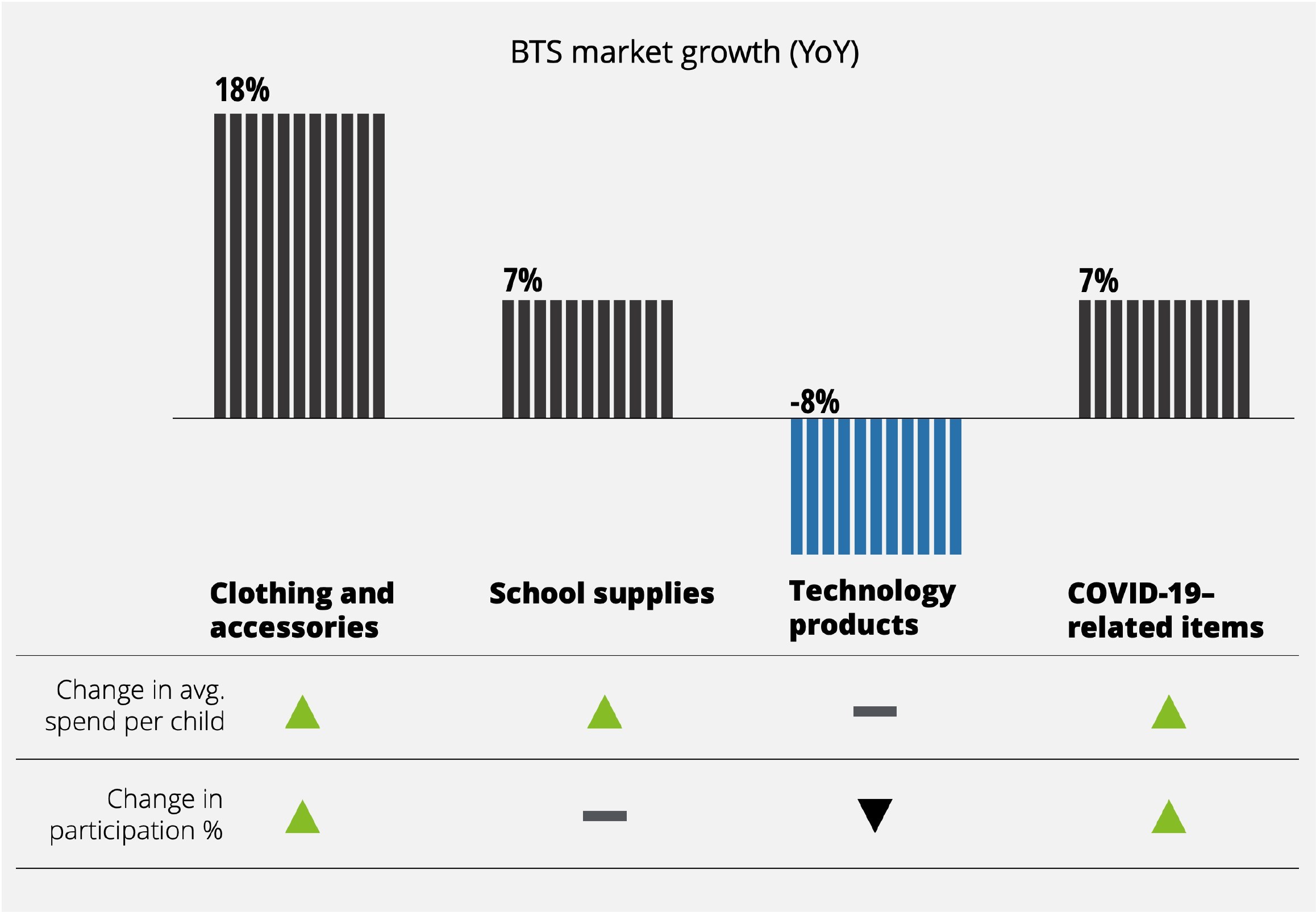

- After a pandemic-fueled tech spree, spending in K-12 this year will likely focus more on clothing (up 18% for respondents year-over-year) and school supplies (up 7%). Technology spending is set to decline 8% this year for respondents, as many parents purchased needed technology supplies last year to meet virtual or hybrid learning needs. In addition, most parents (81%) say their child's school provides the necessary devices and other technology to students.

- In-store shopping is expected to see a resurgence according to survey respondents, accounting for 49% of the overall back-to-school spend, up from 43% in 2021.

- Digital shopping channels reached a saturation point. Although still higher than pre-pandemic levels, consumers indicate digital fatigue. Online's share of the back-to-school spending of K-12 parents surveyed decreased to 35% in 2022 from 39% in 2021. Only 35% of parents surveyed plan to leverage social platforms for their shopping this year, compared to 41% in 2021. While Generation X is using social media to seek deals, millennials are more likely to look for reviews and advice.

- With online shopping, free shipping is vital, with 79% of respondents saying it is more important than fast shipping.

As families reassess priorities, spending habits shift

Over the last few years, the pandemic caused many to focus on mental wellness and sustainability. Spending habits seem to be shifting as more families seek opportunities to address these priorities.

- Following the uncertain social landscape of the past several years, many K-12 parents are focused on their child's overall mental wellness. Half (50%) of respondents are concerned about their child's current mental health; as a result, 36% have purchased products or services in the past year to address this issue.

- Environmental sustainability is also top-of-mind for many, with half of K-12 parents surveyed saying they choose environmentally friendly or responsible sourced back-to-school products whenever possible. Those not selecting sustainable products often point to affordability as their biggest concern.

- These two priorities tend to lead shoppers to spend more — surveyed parents concerned about mental wellness report spending 8% more than the average back-to-school shopper, while those choosing sustainable options expect spending 22% more.

Back-to-college spending still depends on digital

As the pandemic continues to reshape higher education, the influence of digital trends remains. Back-to-college parents surveyed plan to spend $28.3 billion this year, or approximately $1,600 per student, up 10% from those surveyed last year.

- Despite economic concerns, parents of college-age students seem determined to spend, driven by digital integration in the college experience. Spending on technology products is expected to be up 22% year-over-year by respondents, compared to 16% growth in 2021, outpacing other categories including household appliances and supplies (up 12%), clothing (up 10%), and dorm or apartment furniture and supplies (down 15%).

- With 41% of surveyed students attending college in online or hybrid mode, surveyed parents plan to spend the same or more on online learning resources (51%) and buy fewer traditional college supplies (53%).

- As many as 77% of surveyed shoppers are likely to leverage credit sources to finance their back-to-college expenses, up from 70% in 2021.

- In-store's share of back-to-college shopping expected to increase for respondents to 44% in 2022 from 39% in 2021. As retailers continue to offer more tech-enabled shopping tools, parents of college students are ready to leverage them: 59% of respondents will use smartphones for their back-to-college shopping (up from 49% in 2021), 30% will use social media (up from 22% in 2021), and 44% will use emerging technology (up from 29% in 2021 and 26% in 2019).

- Stockouts are a concern for college shoppers with 68% of respondents expecting to encounter them, leading to 56% of planned spending likely occurring by the end of July.

- Many college families are equally concerned about their students' mental wellness (49% of respondents) and are seeking solutions. More than 1-in-3 (36%) of those surveyed will spend on products or services to address their students' mental health.

Key quote

"The continued digitization of the college experience is impacting everything from how students are learning to where families are shopping for supplies, and what they are buying. Online and hybrid schooling options are opening new doors for many to start their college careers, while still others are seeking to level the playing field after more than two years of pandemic schooling, by spending more to overcome both learning loss and mental wellness concerns. Retailers who meet these needs with a shopping experience that leverages the use of digital technologies could be well positioned to drive growth."— Rod Sides, Deloitte Insights leader, Deloitte LLP

Connect with us on Twitter at @DeloitteCB or on LinkedIn @NickHandrinos, @RodSides and @StephenRogers.

About the surveys

The "2022 Deloitte Back-to-School Survey" was conducted online using an independent research panel between May 20 and June 2, 2022 and surveyed 1,200 parents who have at least one child attending school in grades K-12 this fall.The "2022 Deloitte Back-to-College Survey" was conducted online using an independent research panel between May 20 to June 14, 2022. The survey polled a sample of 950 parents of children heading to colleges and universities this fall.

About Deloitte

Deloitte provides industry-leading audit, consulting, tax, and advisory services to many of the world's most admired brands, including nearly 90% of the Fortune 500® and more than 7,000 private companies. Our people come together for the greater good and work across the industry sectors that drive and shape today's marketplace—delivering measurable and lasting results that help reinforce public trust in our capital markets, inspire clients to see challenges as opportunities to transform and thrive, and help lead the way toward a stronger economy and a healthier society. Deloitte is proud to be part of the largest global professional services network serving our clients in the markets that are most important to them. Building on more than 175 years of service, our network of member firms spans more than 150 countries and territories. Learn how Deloitte's more than 345,000 people worldwide connect for impact at www.deloitte.com.Deloitte refers to one or more of Deloitte Touche Tohmatsu Limited, a UK private company limited by guarantee ("DTTL"), its network of member firms, and their related entities. DTTL and each of its member firms are legally separate and independent entities. DTTL (also referred to as "Deloitte Global") does not provide services to clients. In the United States, Deloitte refers to one or more of the US member firms of DTTL, their related entities that operate using the "Deloitte" name in the United States and their respective affiliates. Certain services may not be available to attest clients under the rules and regulations of public accounting. Please see www.deloitte.com/about to learn more about our global network of member firms.

-